What is risk matrix calibration?

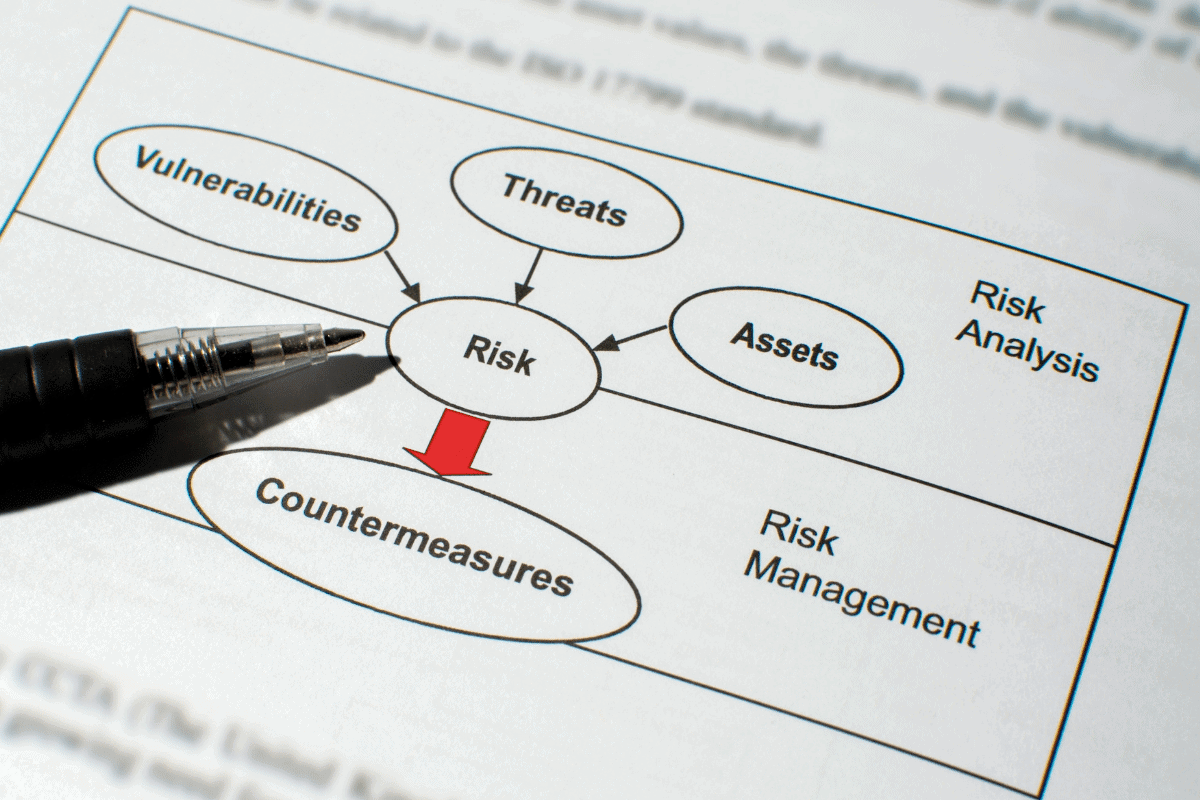

Risk matrix calibration, or risk assessment matrix calibration, entails deciding on risk reference values against risk categories such as financial cost, delivery schedule and performance.

Risk categories are the classification of risks per a business’s activities and provide a defined overview of the underlying and potential risks faced by the company. The most commonly used risk category classifications include financial, schedule, performance, reputation, health, safety and environment.

What is a Risk Matrix?

A risk matrix (sometimes called a risk assessment matrix) is used during the risk management process’s risk assessment stage. It identifies and captures risk event likelihood (probability) and evaluates the potential impact (consequences) caused by those risk events.

Risk Evaluation

When the risk analysis is complete, it’s necessary to compare the estimated risks against the risk criteria of the organisation.

Risk criteria may include, for example, cost, health, safety, environmental standards, legal requirements, socioeconomic factors, and the concerns of stakeholders.

Risk evaluation supports decisions regarding the significance of a risk to the organisation; and if a specific risk should be accepted, controlled, or mitigated.

Risk Likelihood

The Risk Likelihood is the probability of a risk event occurrence. The likelihood of risk has five qualitative ranges [Ref: The Institute of Risk Management]:

- Remote

- Unlikely

- Possible

- Probable

- Highly Probable

Risk Impact

The Risk Impact considers the consequence if the risk event occurred and has five levels [Ref: The Institute of Risk Management]:

- Insignificant

- Minor

- Moderate

- Major

- Extreme

The risk event is then assigned a risk value, obtained as the function of Likelihood and Impact.

Examples of Risk Matrix Calibration

Likelihood

| Likelihood | Example Criteria |

| Remote | Not known to have happened anywhere |

| Unlikely | It has happened previously somewhere |

| Possible | It has happened previously in the local country |

| Probable | It has happened previously in the industry sector |

| Highly Probable | This has happened previously in the business |

Impact

Financial

| Impact | Example Criteria |

| Insignificant | A financial loss of <$10k |

| Minor | A financial loss of <$100k |

| Moderate | A financial loss of <$1m |

| Major | A financial loss of <$10m |

| Extreme | A financial loss of <$100m |

Schedule

| Impact | Example Criteria |

| Insignificant | A schedule loss of 1 day |

| Minor | A schedule loss of 4 days |

| Moderate | A schedule loss of 1 week |

| Major | A schedule loss of 1 month |

| Extreme | A schedule loss of 1 year |

Reputation

| Impact | Example Criteria |

| Insignificant | Attention within the business only. Insignificant business impact. |

| Minor | Local media attention. Minor business impact. |

| Moderate | National media attention and possible public inquiry. Moderate business impact. |

| Major | International media attention and public inquiry. Major business impact. |

| Extreme | International media attention and public inquiry. Business closes down. |

Performance

| Impact | Example Criteria |

| Insignificant | Requires minor trade-offs to achieve the target. No impact on business. |

| Minor | Performance below target but acceptable.No changes. No business impact. |

| Moderate | Performance below target. Moderate changes are required. Limited business impact. |

| Major | Performance is unacceptable. Major changes are required. Major business impact. |

| Extreme | Performance is unacceptable. |

Health

| Impact | Example Criteria |

| Insignificant | No harm to people |

| Minor | A few people suffer from diseases |

| Moderate | Some people suffer from grave diseases |

| Major | Possible deaths, and many people suffer from grave diseases |

| Extreme | Likely deaths |

Safety

| Impact | Example Criteria |

| Insignificant | Minor injury or no harm to people |

| Minor | A few minor injuries |

| Moderate | Some serious injuries |

| Major | Possible deaths and serious injuries |

| Extreme | Likely deaths |

Environmental

| Impact | Example Criteria |

| Insignificant | Minor release |

| Minor | Small release |

| Moderate | Significant release |

| Major | Large release |

| Extreme | Large uncontrolled release |

Final Thoughts

Before evaluating a risk event, the risk categories must be calibrated.

Each business and organisation is unique. Therefore, so are the risk reference values, i.e. the loss of $100k could be a minor impact for one company but become the final closure factor for another business.